On September 22, 2020, the New Development Bank (NDB) priced its USD 2 billion, 5-year COVID Response Bond in the international capital markets, following its inaugural issuance on June 16, 2020. This is the NDB’s largest-ever USD benchmark bond to date.

The net proceeds of the bond issuance will be used to finance sustainable development activities in the Bank’s member countries, including COVID-related emergency assistance programs. NDB is targeting to provide up to USD 10 billion in crisis-related assistance, including financing healthcare and social safety-related expenditures as well as supporting economic recovery efforts.

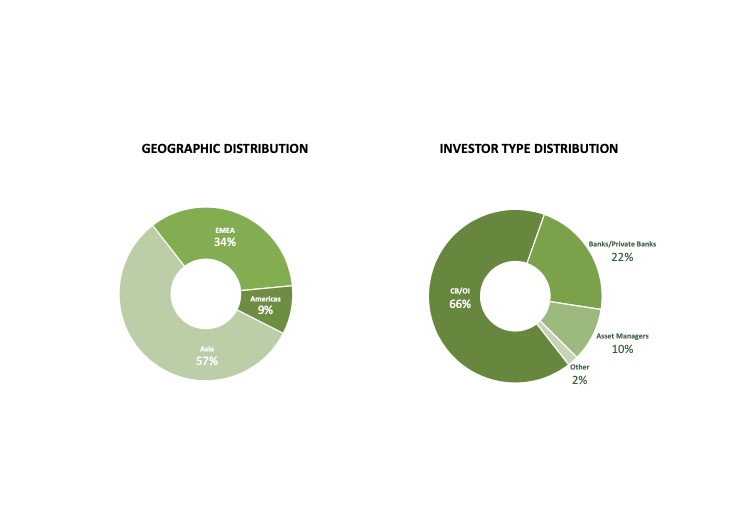

The transaction marks NDB’s second foray into the international capital markets following a highly successful inaugural benchmark issuance. The transaction garnered notable demand from a geographically diverse investor base, and substantial participation from central banks and official institutions, which accounted for 66% of final allocations. The geographic distribution of investors of the final bond book was: Asia – 57%, EMEA – 34%, Americas – 9%.

The 5-year benchmark bond was issued at a spread of 37 bps over mid-swaps and pays a fixed annual coupon of 0.625%. Bank of China, Barclays, Citi, Goldman Sachs International and Standard Chartered Bank are acting as lead managers of the bond issuance.