On December 1, 2021, the New Development Bank (NDB) priced its 3-year USD 500 million SOFR-linked floating rate Pandemic Support and Sustainable Bond. This transaction has become the first floating rate benchmark of the Bank and its fifth USD benchmark bond offering in the international markets.

The net proceeds from the Bond will be used for financing sustainable development activities and providing COVID-19 emergency support loans to the member countries of the Bank. The Board of Directors of the NDB approved nine emergency support loans totaling approx. USD 9 billion in response to the adverse health, social and economic impact of the COVID-19 pandemic. NDB targets to provide a total of USD 10 billion in crisis-related assistance.

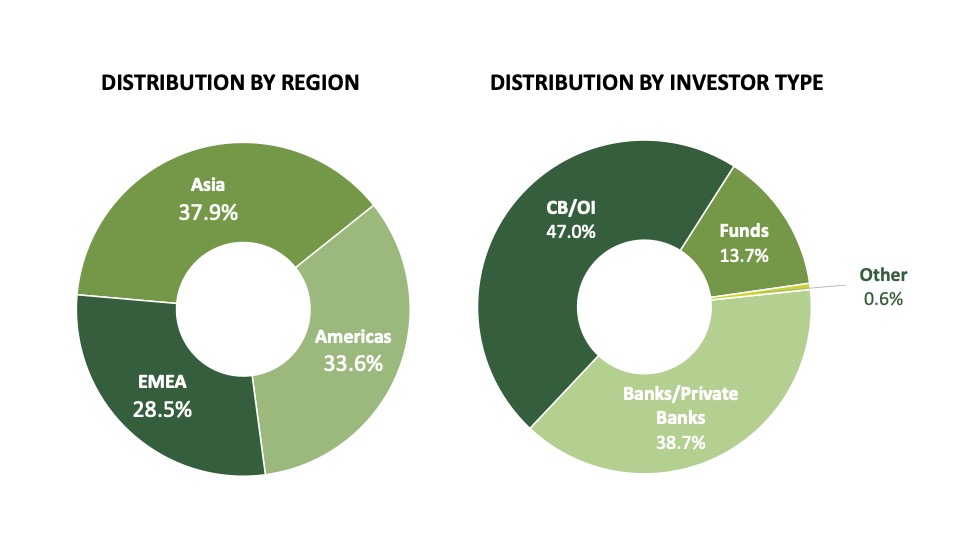

The transaction received strong interest from the global investor community following the mandate announcement. The debut SOFR-linked floating rate bond set the spread at SOFR +28bps, with a tightening of 2 bps from initial pricing thoughts. The orderbook was supported by high quality investors. The distribution of investors of the final book was as follows, by region: Asia – 37.9%, Americas – 33.6%, EMEA – 28.5%, and by investor type: CB/OI – 47%, Bank/Private Bank – 38.7%, Fund Manager – 13.7% and Other – 0.6%.

Barclays, Citi, Deutsche Bank, Goldman Sachs International and TD Securities acted as joint lead managers for the transaction.