On April 20, 2021, the New Development Bank (NDB) priced its 5-year USD 1.5 billion benchmark bond. This transaction is the third USD benchmark bond offering of the Bank in the international markets.

The net proceeds of the bond will be used for financing sustainable development activities as well as COVID-19 Emergency Program Loans to the Bank’s member countries. The NDB established the Emergency Assistance Facility in April 2020, to provide up to USD 10 billion in crisis-related assistance to its member countries, including USD 5 billion for financing healthcare and social safety-related expenditures, as well as USD 5 billion for supporting economic recovery efforts.

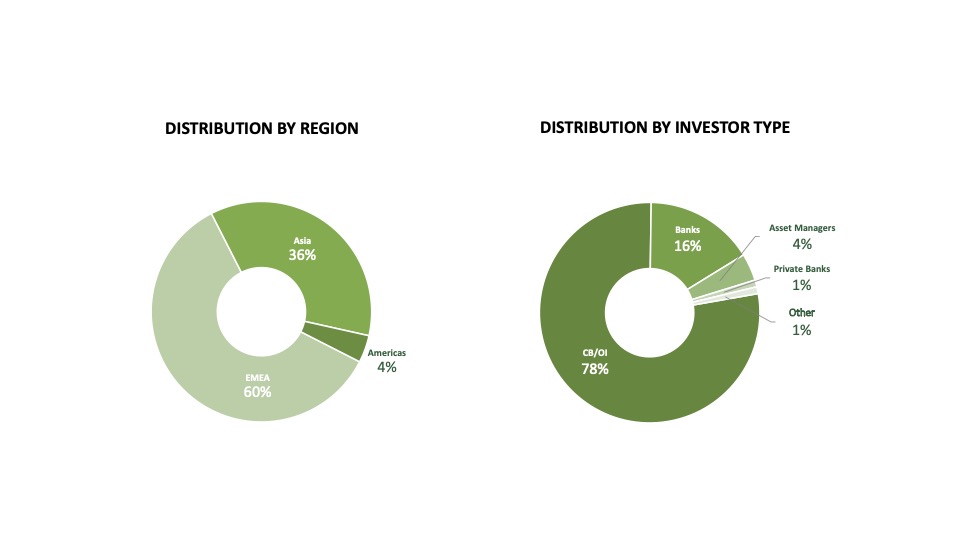

This transaction was met with significant support from global investor community, the high-quality order book highlights the recognition of NDB’s mandate and its growing stature in the USD market. The distribution of investors of the final book was as follows, by geography: Asia – 36%, EMEA – 60%, Americas – 4% and by investor type: Central Banks/Official Institutions – 78%, Banks – 16%, Asset Managers – 4%, Private Banks – 1%, Others – 1%. The book was oversubscribed with the order book in excess of USD 1.975 billion.

The bond was priced with no new issue premium at MS +25bps. The final price was a tightening of 2bps from initial pricing thoughts and coupon was set at 1.125%. Citigroup Global Markets Limited, HSBC London PLC, Industrial and Commercial Bank of China (Asia) Limited, J.P. Morgan P, Standard Chartered Bank UK, TD Securities (Canada) Inc. acted as lead managers for the transaction.