In July 2016, the NDB successfully issued its first bond in China for an amount of CNY 3 billion (USD 450mn) and a tenor of 5 years.

It was the first time that an international financial institution issued a green financial bond in the China Interbank Bond Market and it was also the first time for the NDB to tap the capital market.

The total subscription amount of the NDB’s first bond reached more than CNY 9 billion and the cover ratio reached 3.1. More than 30 investors participated in the bond book building.

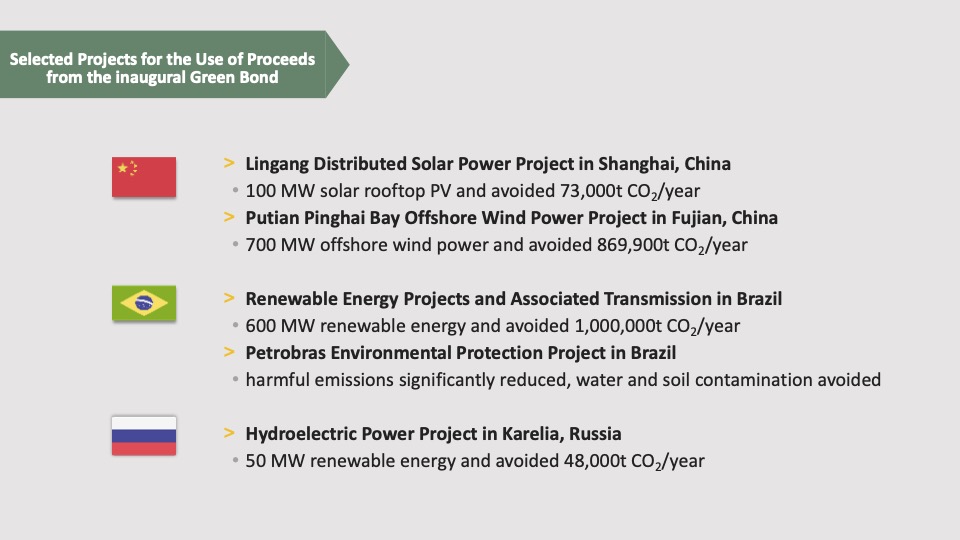

The proceeds of the bond are used for infrastructure and sustainable development projects in the NDB member countries.

Ernst & Young Hua Ming LLP has undertaken independent assurance verification of the bond in accordance with the Green Bond Principles published by International Capital Market Association (ICMA) and the Green Bond regulations in China.

During the duration of the bond, the NDB discloses the information on the use of proceeds on a quarterly and annual basis on the http://www.chinamoney.com.cn/chinese/index.html and http://www.shclearing.com/ which is designated by the People’s Bank of China.