On February 25, 2019, the NDB successfully placed its debut CNY 3 billion bond in the China Interbank Bond Market under the Programme registered on January 9, 2019.

It was the second bond placement of the NDB in China. The bond was placed in two tranches with maturities of 3 years (CNY 2bn) and 5 years (CNY 1bn) and it was priced at the lower end of announced pricing range with coupon rates of 3% and 3.32% respectively.

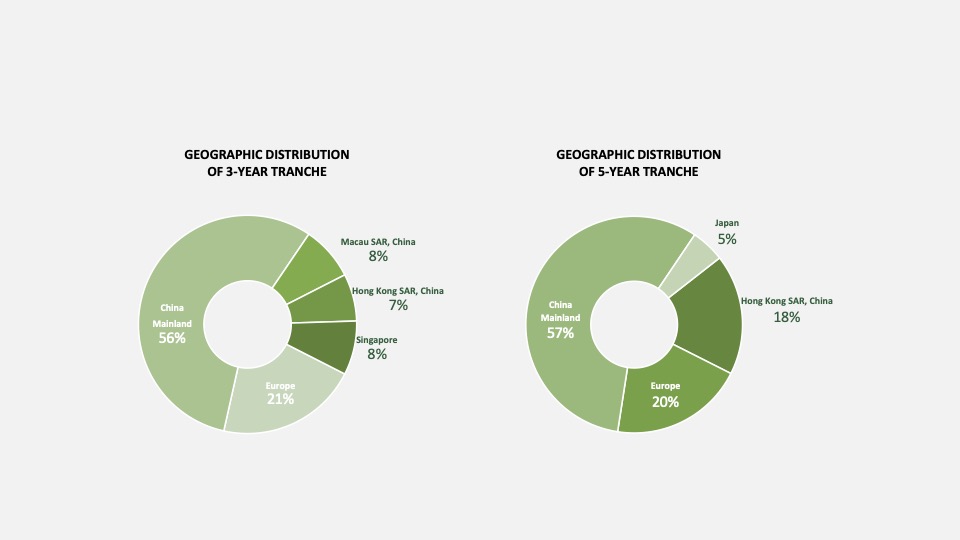

The bond was more than 3 times oversubscribed with more than 20 orders from domestic state-owned, joint-venture and rural banks, fund companies, securities companies, foreign banks and sovereign funds. The orders were balanced from onshore and offshore investors. For tranche-1 (3-year bond), China Mainland represented 56% of investors, Europe – 21%, Singapore – 8%, Macau SAR – 8% and HK SAR – 7%, while for tranche-2 (5-year bond) China Mainland represented 57% of investors, Europe – 20%, HK SAR – 18% and Japan – 5%.

The NDB became the first international financial institution to issue CNY Bond under the Interim Measures for the Administration of Bonds Issued by Overseas Issuers on the National Interbank Bond Market announced by People’s Bank of China and China’s Ministry of Finance [2018] No. 16 (the Measures) issued on September 25, 2018.