On March 24, 2021, the New Development Bank successfully issued a new 3-year fixed rate CNY 5 billion Bond in the China Interbank Bond Market. The Sustainable Development Goals (SDG) bond was issued under the UNDP Sustainable Development Goals Impact Standards for Bonds (UNDP SDG Standard) as well as the SDG Finance Taxonomy (China) and was issued as a part of the Bank’s CNY 20 billion Bond Programme.

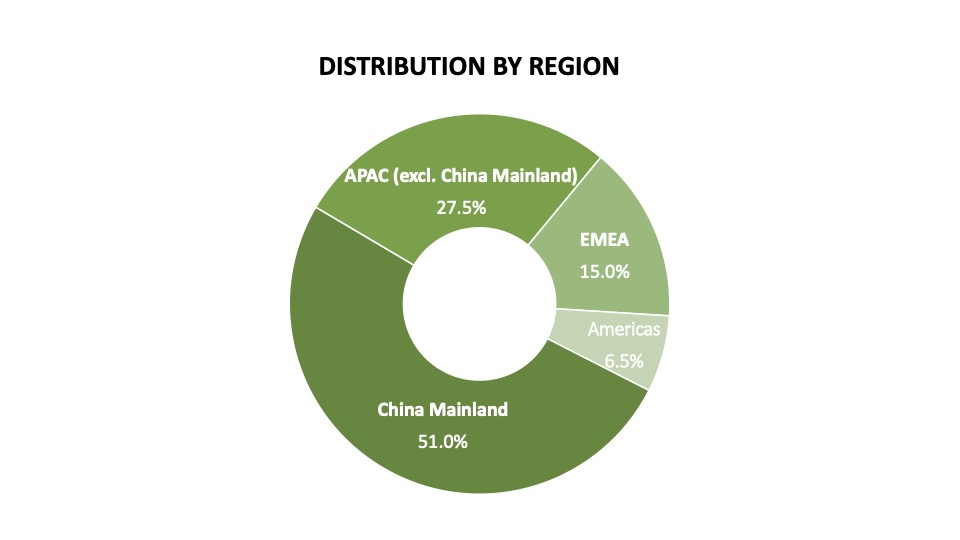

The bond was priced at the tighter end of price guidance at a yield of 3.22%. The transaction garnered notable demand from a geographically diverse investor base. The final order book was in excess of CNY 10 billion, more than 2 times oversubscribed. The geographic distribution of investors was as follows: China Mainland – 51%, APAC (excl. China Mainland) – 27.5%, EMEA – 15%, Americas – 6.5%.

NDB has become the first issuer to use the UNDP SDG Standard as well as the SDG Finance Taxonomy (China) in the debt capital market.