On January 27, 2022, the New Development Bank (NDB) successfully issued CNY 3 billion RMB-denominated Bond in the China Interbank Bond Market. With this issuance under the Bank’s second CNY 20 billion Bond Programme in China, the total outstanding amount of CNY bonds issued by the NDB has reached CNY 20 billion, making the Bank one of the largest panda bond issuers in the market.

The net proceeds from the sale of the Bond will be used onshore as general corporate resources of the NDB and to finance infrastructure and sustainable development activities in the Bank’s member states.

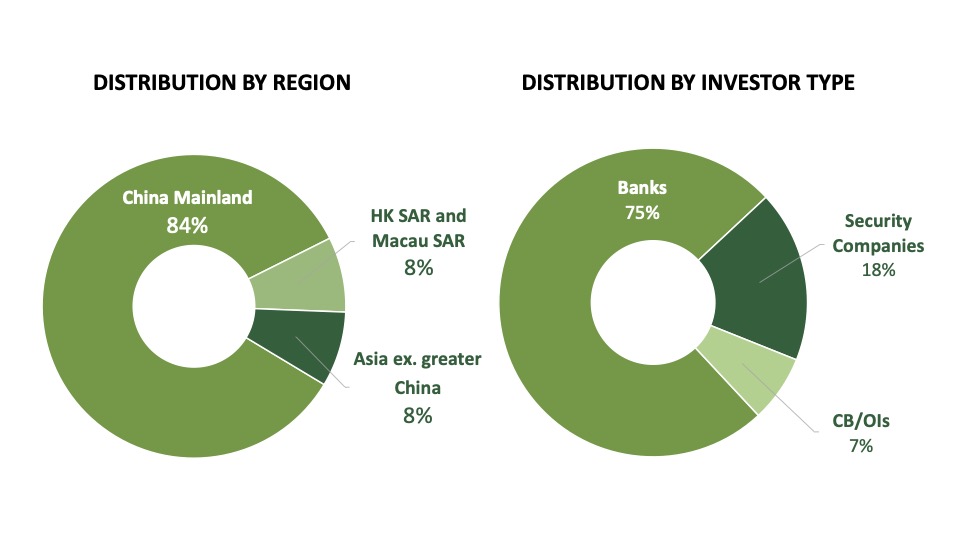

The transaction saw strong interest from both onshore and offshore CNY investors and the issue was subscribed 1.5 times. The distribution of investors by region was as follows: China Mainland – 84%, HK SAR and Macau SAR – 8%, Asia excluding greater China – 8%. Investor distribution by type was as follows: Banks – 75%, Security Companies – 18%, CB/OIs – 7%.

Bank of China Ltd. acted as the lead underwriter of the Bond. Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., DBS Bank (China) Ltd., Deutsche Bank (China) Co., Ltd., CITIC Securities Co., Ltd., China International Capital Corporation Ltd. acted as joint-lead underwriters.